Trends in Base Erosion and Profit Shifting

Profit shifting is smaller than you think and has most recently fallen to its lowest level in over a decade.

Policymakers across the political spectrum and around the world are concerned about global profit shifting—whereby multinational businesses artificially shift paper profits between countries to lower their effective tax rates and erode the domestic tax base. These concerns have motivated decades‐long policy initiatives to stop profit shifting with costly new international tax rules. However, data indicate that profit shifting is economically small and, following the 2017 U.S. corporate tax cut, profit shifting has steadily declined.

Knowing the magnitude and distribution of multinational profits around the world is critical to assessing the validity of proposed policy responses, such as domestic proposals by President Biden or the global tax increases proposed by the OECD. Unfortunately, the data on the location of corporate income around the world is notoriously imperfect and difficult to interpret, given the complex structures of modern multinational firms. This piece first assesses data from the U.S. Bureau of Economic Analysis (BEA) on the location of multinational foreign profits. Then, it puts those estimates into the context of total corporate profits, concluding that the share of total corporate income reported in tax havens has grown modestly over time and has most recently fallen to its lowest level in over a decade.

Where in the World Do Firms Report Income?

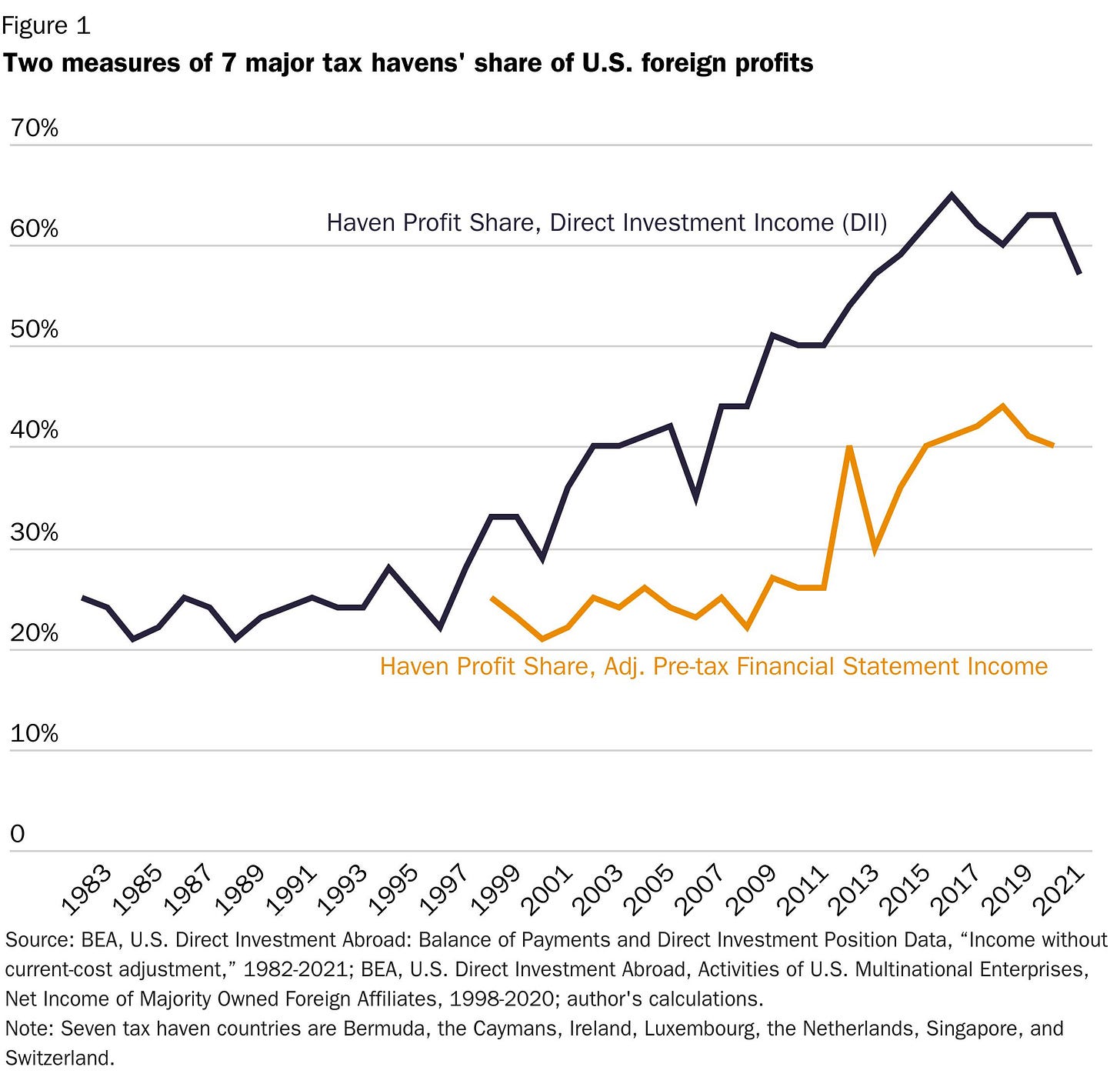

Simple measures of foreign corporate profits show a precipitous rise in the share of income reported in tax havens beginning in the 1990s. Other measures that better attribute income to its original source show a much lower level of income in tax havens and significantly temper the increasing trend over time.

The top line in Figure 1 shows the share of U.S. multinational foreign direct investment income (DII) reported in seven low‐tax tax havens as a share of all foreign income.1 The DII data show the key trend motivating policy concerns over increasing profit shifting. By this measure, the tax haven share began to rise from about 25 percent of all foreign profits in the 1980s to 65 percent in 2016. The data show a clear shift in trend in 2017, after which the tax haven share of U.S. multinational foreign profits declined. However, DII systematically overstates income reported in tax havens relative to higher tax jurisdictions. The second line in Figure 1 presents a more accurate measure of the havens’ share.

Because multinationals tend to own affiliates in high‐tax countries through holding companies in low‐tax countries, DII does not correctly source income to its appropriate affiliate. For example, if a U.S. multinational parent owns a German affiliate through an intermediate holding company in the Netherlands, BEA reports the German income on the Netherlands’ account due to the cascading ownership structure. DII is also reported after‐tax, which mechanically biases up tax‐haven profits (which face low or no taxes) compared to higher‐tax, non‐haven countries.

The BEA reports a second series on the activities of U.S. multinationals, but it also systematically overstates foreign income in tax havens.2 The data on net income from activities of U.S. multinationals’ foreign affiliates double counts the profits of affiliates owned through an intermediary.3 Jennifer Blouin and Leslie Robinson suggest removing equity income and adding back foreign tax expense to estimate adjusted pre‐tax income (Adj. PTI), shown as the lower line in Figure 1. Adjusted PTI is a more faithful accounting of where profits are earned, but there remains some disagreement as to whether removing all equity income may over‐correct the data and understate some profit shifting.

The adjusted PTI series shows that the haven profit share is significantly lower than reported by DII. Through the 2000s, the haven share of adjusted foreign profits averaged 25 percent, reaching 44 percent in 2018. Over the last decade, the havens’ share of adjusted PTI is about 22 percentage points lower than as measured by DII.

These data show that multinational firms have increased the share of foreign profits reported in tax havens, but simple measures overstate both the level and the magnitude of the shift over time.

Profit Shifting Is Economically Small

The trend in the tax haven’s share of foreign profits only tells part of the story. The overall magnitude of income reported in tax havens is relatively small compared to total U.S. corporate income.

Figure 2 shows tax haven DII as a share of total foreign and domestic U.S. corporate profits. By this measure, haven profits averaged about 6 percent before 2007 and 15 percent after 2008. In 2021, tax haven profits were 11.3 percent.4 The financial crisis and subsequent policy uncertainty likely accelerated the use of more aggressive tax planning, leading to the increase in haven profits in the late 2000s. Due to DII’s overreporting of haven profits, Figure 2 shows an upper bound of haven income.

Adjusted PTI does not have a precisely comparable worldwide measure, but tax haven’s adjusted PTI share of total U.S. multinational net income (a smaller universe than all corporate profits) was 11 percent in 2020 and follows a similar trend to that in Figure 2.

The small magnitude of profit shifting is also apparent in the aggregate corporate tax data. If profit shifting significantly erodes countries’ tax bases, corporate tax revenue in higher‐tax countries should decline. However, as I’ve written previously, data from the mostly higher‐tax OECD countries show that aggregate corporate tax revenue has trended up, not down, over the last 40 years. Corporate tax revenue as a share of the economy increased from 2.4 percent in 1981 to 3.5 percent in 2021 across 22 OECD countries. Corporate tax revenue as a share of all revenue has also trended up since the 1980s. These trends are even more impressive given that the average corporate income tax rate across the same OECD countries was cut in half during the same time, falling from about 48 percent in the early‐1980s to 24 percent in 2021.

The corporate revenue data is consistent with the trend in Figure 2. The share of total U.S. corporate income reported in tax havens grew modestly before 2008, remained relatively flat through 2017, and most recently fell to its lowest level in 14 years.

Conclusion

It is important to remember that tax haven income is not necessarily harmful and very likely creates economic benefits. For example, foreign low‐tax investments are associated with additional complementary domestic investments that lead to higher employment levels and wage growth at home. Profits reported in tax havens are also not necessarily moved there artificially but instead are often associated with real economic activity and physical investments. In one estimate, approximately 60 percent of reported tax haven profits were not artificially tax‐induced but rather the result of real investment activity.

Lastly, all three measures of tax haven profits show that profit shifting stopped increasing and began to fall around the time of the 2017 corporate income tax cut. In 2018, the U.S. federal corporate tax rate fell from 35 percent to 21 percent, almost entirely closing the 12‐percentage point gap between the combined U.S. tax rate and the OECD average. This data suggests that a lower corporate tax rate is the most effective reform to reduce profit shifting.

Despite the flaws, the data on the distribution of foreign profits should give pause to policymakers proposing novel international tax increases to combat profit shifting. The mechanisms used to prevent profit shifting usually come with high compliance and other economic costs that may outstrip promises of higher tax revenues, especially if profit shifting is already small and declining.

The seven tax haven countries follow the convention used by former Treasury Deputy Assistant Secretary for Tax Analysis Kimberly Clausing (Bermuda, the Caymans, Ireland, Luxembourg, the Netherlands, Singapore, and Switzerland). BEA, U.S. Direct Investment Abroad: Balance of Payments and Direct Investment Position Data, “Income without current‐cost adjustment,” 1982–2021, https://www.bea.gov/international/di1usdbal.

BEA, U.S. Direct Investment Abroad, Activities of U.S. Multinational Enterprises, Net Income of Majority Owned Foreign Affiliates, 1998–2020, https://www.bea.gov/international/di1usdop.

For example, the income of a U.S.-owned German affiliate through a Netherlands holding company is reported first in Germany and then in the Netherlands as “income from equity investments,” thus counting the German income twice. In more complex ownership chains, income could be counted many more than two times.

The denominator is corporate profits from the BEA National Income and Product Accounts, Table 6.19D, Corporate Profits After Tax by Industry. All country DII and NIPA corporate profits from the rest of the world are derived from similar data, with adjustments to some income concepts. After these adjustments, all country DII and income from the rest of the world still follow almost identical trends and levels, with small discrepancies in a few years.