Welcome back to the second installment of the Tax Tracker.

This week, we start with a roundup of events as Congress gears up for next year’s tax fight, then turn to new data on who pays taxes, the future of the OECD tax cartel, and the fight for permanent, pro-growth tax cuts.

If you were looking for an event on the future of tax policy in 2025, you are in luck! Over the past couple of weeks, events and hearings have been hosted by the Tax Foundation, Brookings, Tax Notes, Yale Budget Lab, National Taxpayers Union, FREOPP, the Joint Economic Committee (JEC), and the Senate Banking Committee. The key takeaways were that reforms should focus on the most pro-growth tax cuts (expensing and the corporate rate), the size of the deficit should be a real concern to policymakers, and tariffs don’t raise all that much revenue as an offset because they have such high economic costs.

Looking out a few more weeks, Cato will host our own event on the Hill on December 12, covering tax and budget issues in 2025. Sign up here to join us: “Empowering the DOGE and Extending Pro-Growth Tax Cuts: How the 119th Congress Can Grow the Economy and Fix the Debt.”

Here are this week’s tax highlights:

Your regular reminder that the rich already pay high taxes. Scott Hodge of the Tax Foundation digs into a recent Treasury study to show “that the rich not only pay more than the middle class, they pay more than one-third of their annual income in federal taxes and more than 45 percent when state and local taxes are included.” The report shows that the wealthiest 92 US tax units (the top 0.00005 percent) pay the highest total federal, state, and foreign effective tax rates of nearly 60 percent.

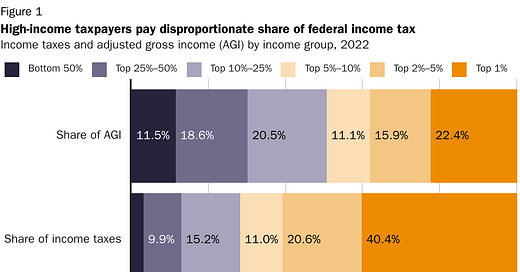

Recently released data from the IRS for tax year 2022 tells a similar story. The highest-income Americans pay the highest federal income tax rates and the lion’s share of the total tax burden. For example, the top 1 percent by adjusted gross income (AGI) earned 22 percent of the reported income and paid 40 percent of all federal income taxes.

Related links:

Summary of the Latest Federal Income Tax Data, 2025 Update

Erica York, Tax Foundation

Trump could doom OECD global tax plans. Emma Agyemang and Paola Tamma report in the Financial Times that the OECD’s ambitious plans to raise taxes on America’s most profitable business through a two-pillar tax cartel are “in peril.” As I’ve been arguing for the better part of the last two years, “the conventional wisdom that Pillar Two—particularly the extraterritorial components of the UTPR—will move forward [without the US] is overstated.” A renewed forceful congressional message rejecting the OECD framework will accelerate the now increasingly likely scenario that the two-pillar framework collapses under its own weight. The best antidote to the OECD extraterritorial tax grab is making the TCJA’s expensing provisions permanent and further cutting the corporate tax rate to attract global investment.

Related links:

Trump Win Casts Shadow Over OECD Global Tax Reforms

Stephanie Soong and Andrew Velarde, Tax Notes

Pillar Two Implementation in Europe, 2024

Alex Mengden, Tax Foundation

Bold International Tax Reforms to Counteract the OECD Global Tax

Adam N. Michel, Cato Institute

Temporary tax cuts undermine potential growth. The budgetary and political hurdles of a full TCJA extension are significant, clocking in at more than $4 trillion over ten years—not to mention any additional changes to SALT, the child tax credit, and the treatment of tipped income. With so many pressure points, Doug Sword of Tax Notes reports that a “three to five years [extension] is more likely than eight years.” Temporary changes help hide the long-run fiscal hit and make fitting the changes in reconciliation easier.

Temporary tax cuts—especially for businesses and investment—undermine the potential for long-run economic growth. Following the passage of the TCJA, Parker Sheppard and I estimated that a permanent version of the law would have resulted in 65 percent more GDP growth and double the addition to the capital stock. In his JEC testimony, Doug Holtz-Eakin describes deficit-neutral tax cuts as “the gold standard” because it would make progress toward broader fiscal goals by cutting low-value spending and allow for permanent tax changes in reconciliation. A temporary tax extension leaves substantial economic gains on the table. You can check out my lists of tax expenditures and spending cuts that would make passing a permanent tax cut package easier.

Related links:

Why Some Tax Cuts Can Be Better Than Others

Richard Rubin, Wall Street Journal

Joshua Loucks contributed to this post.