Tax Tracker | Senate’s Budget, Top Rate, International Tax, C-SALT

Links for the 2025 tax debate and the Cato Milton Friedman Prize.

Welcome to April! I hope you’ve finished your taxes already—if not, get on it.

My Tax Expenditure Madness bracket is closing in on a champion for worst tax expenditure. The final four are up. Vote here!

This week’s Tax Tracker starts with a reconciliation update, covers Republicans for increasing top marginal rates, reviews recent international tax developments, and compiles all the resources you need on the debate over corporate state and local tax deductions (C-SALT).

Here’s this week’s tax highlights:

Reconciliation, inching along. It has been over a month since the House passed its budget resolution. The Senate keeps inching closer to taking up something similar to the House framework, but there has been no concrete movement yet. One possible path being considered is for the Senate to reduce the House’s up to $2 trillion in spending cuts to just $3 billion over ten years. If the Senate parliamentarian gives the ok, this may be paired with a current policy baseline (pretending the tax cuts have no deficit effects). Could the Senate come up with a weaker package if they tried? Fiscal hawks in the Senate have demanded $2 trillion in spending cuts to match the most aggressive version of the House bill.

One point of agreement between the two chambers seems to be raising the debt limit in reconciliation. The Congressional Budget Office recently projected the government will hit the debt limit after exhausting extraordinary measures in August or September 2025. Lower-than-expected tax payments could mean the limit will be hit in late May. Raising the debt limit in reconciliation could add pressure to pass a tax bill quickly and give fiscal hawks additional leverage to ensure meaningful spending cuts are included in the budget resolution.

Related links:

Projections of Deficits and Debt Under Alternative Scenarios for the Budget and Interest Rates

Phillip Swagel, Congressional Budget Office

Congress Must Pump the Brakes on Spending to Avoid a Disastrous Future

David Ditch, Economic Policy Innovation Center

Addressing Medicaid Money Laundering

Brian Blase, Niklas Kleinworth, Paragon Institute

Republicans for raising taxes? In addition to cheering on a trillion-dollar tax increase, Axios reports that the Trump administration has discussed allowing the top individual income tax rate to return to its pre-2018 level of 39.6 percent (up from the current 37 percent). This could pay for Trump’s campaign promise to eliminate taxes on tips. Neither idea is good.

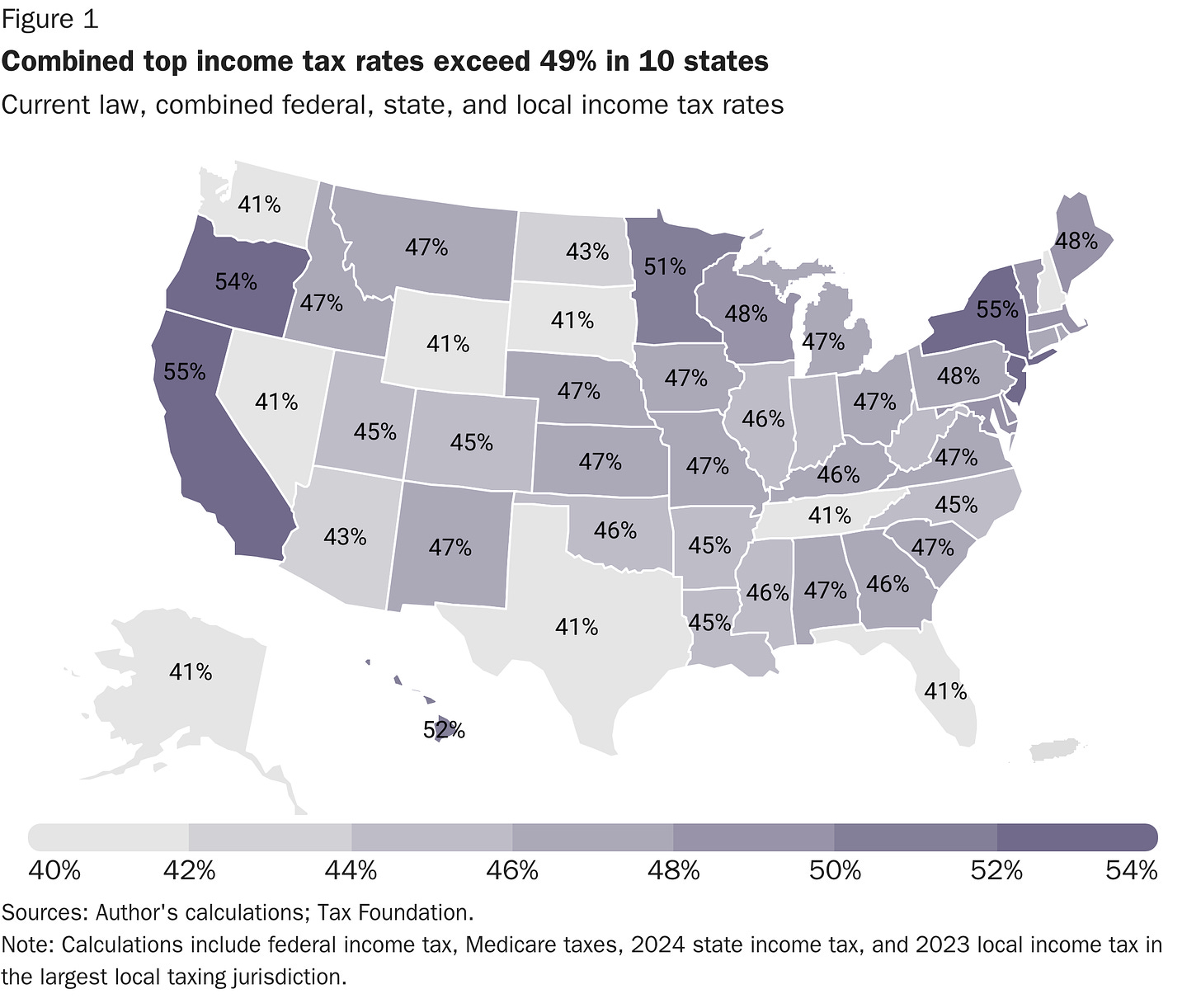

As I estimated in 2024, income tax rates are already on the wrong side of the Laffer Curve in 10 states. With a federal top rate of 39.6 percent, 28 states will have tax rates so high they could lose revenue. Top income tax rates not only hit entrepreneurs but also handicap many small and family-owned businesses that pay their taxes at individual income tax rates and compete with larger C corporations.

Raising taxes to pay for exempting tips makes the proposal even worse. As I've written, no tax on tips is deeply unfair, favoring “tipped service sector jobs by making them more attractive compared to other equally difficult, low-wage jobs like janitors, home health aides, and retail stockers.”

Related links:

Uber, DoorDash Want ‘No Tax on Tips’ to Include Their Drivers

Richard Rubin, Wall Street Journal

Don’t sleep on potential international tax changes. Ways and Means Republicans recently reintroduced the “Unfair Tax Prevention Act,” a retaliatory tax measure to deter the OECD’s Pillar Two taxes from hitting American businesses. To get up to speed, I recommend Alan Cole’s new thorough review of the many nuanced challenges and coming changes in the international tax system. He concludes that while there are lots of ways to improve the TCJA’s international tax system, raising revenue through changes in these rules is misguided because “tax policies on international corporate income are among the least efficient and most complex.” To bring US business profits and investment back to the US, I’ve argued that the experience of the 2017 tax cuts suggests “that a lower corporate tax rate is one of the most effective reforms to reduce profit shifting.”

Related links:

Adam Michel, Cato Institute

A Mandatory High Tax Exclusion for GILTI

Kyle Pomerleau, American Enterprise Institute

Close the Round-Tripping Loophole

George Callas, Arnold Ventures

Corporate SALT round-up. One reform being considered in the tax package is limiting the deduction for corporate state and local taxes (C‑SALT) by extending similar limits on individuals to businesses. I won’t relitigate all the arguments for and against capping the corporate SALT deduction here, but there are now many resources making good arguments for and against the reform. I still think capping business SALT deductions is a worthy reform as part of a pro-growth tax reform package.

Here’s the links in one place:

The Case for Repealing the Corporate SALT Deduction

Adam Michel, Cato Institute

Getting Business or “C” SALT Right

Kyle Pomerleau, American Enterprise Institute

Capping C‑SALT Is Worth the Tradeoff for Pro-Growth Tax Cuts

Scott Hodge, Arnold Ventures

Tread Carefully When Weighing New Corporate SALT Deduction Limits

Jared Walczak, Garrett Watson, Tax Foundation

Growth Should Be a Key Consideration if Corporate SALT Is Limited

Garrett Watson, Daniel Bunn, Tax Foundation

Douglas Holtz-Eakin, American Action Forum

ATR Urges No Reduction in Business SALT Without a Rate Cut

Grover Norquist, Americans for Tax Reform

Cato’s 2025 Milton Friedman Prize for Advancing Liberty. Join us on May 1, 2025, for our biennial dinner and presentation of the Milton Friedman Prize for Advancing Liberty to Charles Koch—businessman, philanthropist, and lifelong advocate for individual liberty. As a participant in the Koch Internship and Associate Programs, I’ve benefited directly from Mr. Koch’s unique insights and unmatched dedication to talent development. I am proud to work for an organization that is recognizing Mr. Koch’s commitment to the principles we fight for every day.