Navigating the Future of International Taxation: A New Report

Congress should focus on increasing the attractiveness of the United States as an international investment destination.

In a landmark move, nearly 140 countries, including the Biden administration, have rallied behind a new global tax system spearheaded by the Organisation for Economic Co‐operation and Development (OECD). This initiative is aimed at increasing taxes on international businesses and puts American companies squarely in the crosshairs.

As countries around the world begin to implement the OECD system and Congress considers the US role, my latest Cato Policy Analysis provides an overview of the international tax system and how we got here. I present data on profit‐shifting trends and propose forward‐looking reforms.

You can read the full report here. What follows is a brief summary.

A Decision of Global Magnitude

In 2025, the United States Congress will face a decision that could redefine the contours of international taxation, tax competition, and global economic growth. The choice is stark: conform to the OECD’s proposed tax increases or break free from what is an aspiring international tax cartel.

The OECD’s proposal aims to disproportionately burden US firms with tax increases using a Two‐Pillar framework. Pillar One aims to change where some companies pay taxes, selectively moving toward a system based on customer location instead of business activities. Pillar Two includes a series of new rules that enforce a global minimum tax of 15 percent.

The OECD has strayed far from its original mission of reducing international business taxes. Today’s proposals resemble an international tax cartel more focused on extracting revenues from America’s leading firms than fostering a conducive environment for global trade and economic expansion.

If the OECD’s tax increases move forward as currently conceived, it risks depressing global investment and institutionalizing a Eurocentric fear that tax competition and successful multinational businesses will undermine their ability to pursue economic planning and wealth redistribution.

Unraveling the Myths of Profit Shifting

The core of the OECD proposal is built on two ideas that are either wrong or dramatically overstated. First, tax competition will deprive countries of the revenue necessary to support the modern welfare state. Second, profit shifting—whereby firms move paper profits to reduce tax burdens—is a significant and growing problem. Both propositions are exaggerated to the point of being inaccurate.

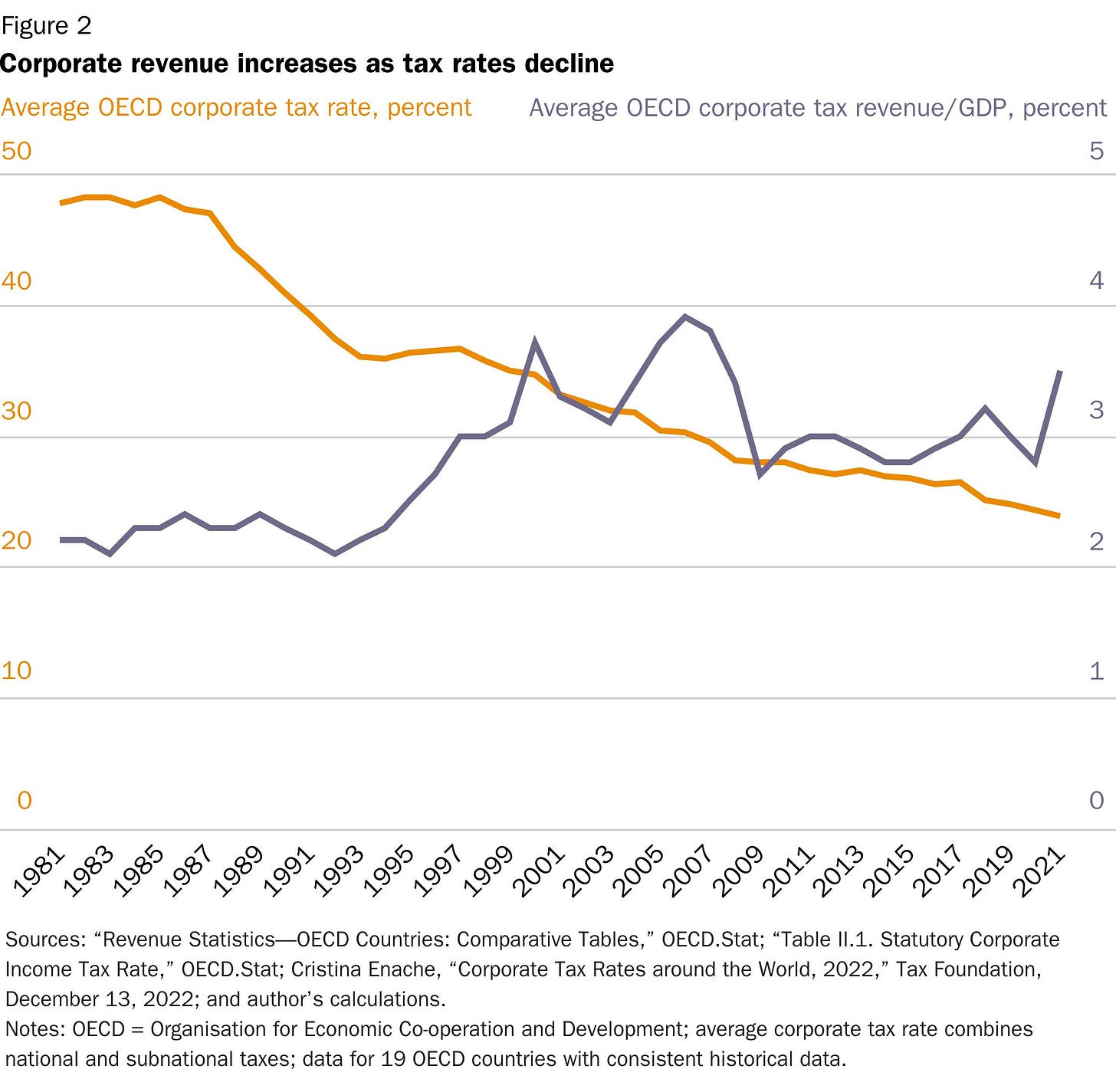

While it’s true that corporate tax rates have declined over the past few decades, this has not resulted in diminished tax revenues, quite the opposite.

Figure 2 from the report shows:

Corporate tax revenue as a share of the economy increased from 2.2 percent in 1981 to 3.5 percent in 2021 across 19 OECD countries. Corporate tax revenue as a share of all revenue has also increased since 1981, rising from 8.6 percent of total revenue to 9.4 in 2021. These trends are even more impressive given that the average statutory corporate income tax rate across the same OECD countries was cut in half during the same time, falling from about 48 percent in the early 1980s to 24 percent in 2021.

Profit shifting to tax havens is also much smaller than typically conceived. Measured correctly, corporate profits in tax havens amount to about 8 percent of total US corporate profits (or as much as 11 percent).

Figure 6 from the report shows two different measures of tax haven profits of US multinationals. The chart shows the share of total US corporate income reported in tax havens grew modestly over time and following the 2017 corporate tax cut, fell to its lowest level in a decade. The data suggest that a lower corporate tax rate is one of the most effective reforms to reduce profit shifting.

A significant share of corporate profits in low‐tax countries are not shifted there artificially but are associated with real investments. However, even the artificially shifted profits still bring benefits.

This body of research indicates that access to tax havens acts like a tax cut on investment that increases investment everywhere, including in nonhaven jurisdictions. Rather than a global scourge that erodes the tax base of high‐tax countries, low‐tax countries help allocate global capital in the face of inefficient tax systems to the benefit of workers and investors around the world. Cutting off domestic business access to low‐tax countries is a lose‐lose; it hurts real foreign and domestic economic activity.

A Fragile Consensus and the Path Forward

Instead of yielding to the OECD’s new global tax, the United States has the opportunity to opt out of the OECD system and redefine itself as the world’s premier business destination. Boosters of the OECD plan will have you believe that the United States is boxed in. The new world order tax cartel is here to stay, and it’s time for Congress to get on board. Fortunately, cartels are inherently unstable, and the agreement is more fragile than the boosters let on.

Instead of ceding authority to the OECD by adopting their new taxes and enacting new rules to stop businesses from leaving the United States, Congress should focus exclusively on increasing the attractiveness of the United States as an investment destination.

My recommendations include slashing the corporate tax rate to 12 percent (if not eliminating it), permanently expanding full expensing to attract new domestic investment, and completing the transition to a fully territorial tax system. With a low enough rate, Congress could repeal most of the complicated alphabet soup—GILTI, FDII, BEAT, CAMT—of existing international rules and minimum taxes.

These reforms would directly support American workers and investment by making the US a preferred destination for new jobs, factories, intellectual property, and easy‐to‐move profits. They would undermine the OECD global tax project by opting out of its scheme, lowering the risk that the destructive tax hikes will move forward as currently conceived.

Read the full report here.